There are a lot of things that could affect your Disney World vacation.

Whether it is bad weather, crowds, or the problems we are currently facing with travel (things like the ever-fluctuating gas prices and continuing flight cancellations) — there are a lot of things you might want to take into consideration when it comes to a Disney vacation. One of those considerations is inflation. Inflation has hit record highs in the United States, but what is it, really? And could it impact your Disney World trip? We’re here to bring you everything you need to know.

What Do You Need to Know About Inflation?

According to The New York Times, inflation is a “loss of purchasing power over time.” This means that the value of the American dollar is decreasing and is not worth as much as it once was, or, essentially, you’ll have to spend more money to get the same goods.

There are a few reasons inflation could increase. The New York Times reports that a big reason for higher inflation has to do with supply and demand. Americans are spending a lot of money because many families amassed savings during the pandemic when they were staying at home. Now, they’re spending that money on a variety of goods and services. The only problem? Supply can’t keep up with it. You may have heard about the ongoing supply chain issues that have caused some goods to become widely unavailable around the country. This is impacting inflation.

As demand for these goods and services increases, so does the price. If consumers are spending and purchasing at high rates, businesses may need to raise prices because they do not have enough supply to keep pace. Another thing that impacts inflation is a myriad of external factors. For example, even two years later, we are still seeing the impacts of the coronavirus on inflation as factories were forced to shut down, limiting the supply of certain goods and products.

Another thing to consider is that many Americans have fought for and won higher pay and salaries. With more money in their pocket, they are likely to want to spend more, again feeding more into the issue of supply being unable to meet demand.

Inflation is measured in a variety of ways, but one of the main ways is to look at something called the Consumer Price Index or C.P.I. The C.P.I. looks at how much consumers pay for the things that they buy. In the United States, the Federal Reserve is responsible for mitigating the rising costs (we’ll talk more about that in a minute) and it pays attention to month-to-month changes to get a sense of the momentum of the price increases.

Click here to see a realistic budget for your 2023 Disney World trip

What’s Going On With Inflation Right Now?

Inflation reached a 40-year high in June, increasing to 9.1% over the past year, making it the biggest yearly increase since 1981, according to the Associated Press. Prices rose 1.3% from May to June.

High inflation rates can lead to an increase in interest rates set by the Federal Reserve (hiking interest rates is how the Federal Reserve tries to mitigate inflation).

UPDATE: According to CNBC, the prices that consumers pay for goods rose 8.5% in July compared to 1 year ago. That actually shows a slightly slower pace compared to the previous months. This appears to be largely due to the drops we’ve seen in gas prices.

Here’s a look at some of the other changes on a monthly basis:

- Energy prices: declined 4.6%

- Gas prices: declined 7.7%

- Food prices: increased 1.1%

- Shelter costs: increased 0.5%

- Used vehicle costs: declined 0.4%

- Airline fares: declined 1.8%

- Electricity prices: increased 1.6% (despite the overall monthly drop in the energy index)

- Real wages for workers: increased 0.5%

When looking at inflation, many officials look solely at something called the “core inflation,” says The New York Times. Core inflation is what inflation looks like without groceries and energy because these two things are more volatile than other goods and services, so including them doesn’t always paint an accurate picture.

The Associated Press reports that “so-called core prices [prices without groceries and energy] rose 0.7% from May to June, the biggest such spike in a year.”

UPDATE: For July of 2022, excluding the “volatile food and energy prices,” the “core” CPI rose 5.9% annually and 0.3% monthly, according to CNBC.

Individuals have indicated that things are “moving in the right direction” and that the latest report (for July of 2022) was one of the most encouraging ones seen recently. The July numbers show that inflation pressures are easing a bit, but things are still near the highest levels seen since the early 1980s.

Some economists were hoping that inflation would reach a short-term peak as gas prices (while remaining higher than they were a year ago) are starting to decrease.

“There may be some relief in the July numbers — commodity prices have come off the boil, at least — but we are a very, very long way from inflation normalizing, and there is no tangible sign of downward momentum,” said Eric Winograd, an economist at an asset management company called AB.

CNBC shares that a peak may not have been reached just yet. According to Greg McBride (a chief financial analyst at Bankrate.com), “To really feel like we’ve hit a peak, we need to see a sustained pullback in a broad range of categories…And we’re not seeing that: Some of the sharpest increases in categories like necessities continue, with food prices up at the fastest pace in 43 years.”

UPDATE: The Orlando Sentinel reported that easing inflation rates, decreasing energy prices, and lower consumer prices may suggest that inflation pressures are easing. After consumer prices rose 6.8% in June, they rose by 6.3% in July, and core inflation also saw a small drop — rising by 4.6% in July, after June saw a 4.8% increase.

President Joe Biden said, “The American people are starting to get some relief from high prices, and the Inflation Reduction Act that I signed last month will also help bring prices down.”

UPDATE: U.S. inflation has slowed for the second straight month as of October 2022, according to the Orlando Sentinel, but excluding energy costs most other items got more expensive in the month of August. Consumer prices rose 8.3% in August, down from 8.5% in July.

But, “core prices” jumped up 0.6% between July and August — 0.3% more than the prior months. Core prices include things like rent, medical services, and cars became more expensive in August, and these prices are generally a clearer indicator on where costs are headed than overall inflation rates.

Groceries continue to be one of the most rapidly increasing costs, jumping up 0.7% from July to August. But nationally, the average cost of a gallon of gas has decreased to $3.71 — much lower than the above $5 average we saw in June.

Click here to see what Disney has to say about inflation and supply chain issues

So, What Does This Have to Do With Disney?

The Associated Press shared that consumer spending is moving away from things like tangible goods, and is moving towards experiences like “vacation travel, restaurants meals, movies, concerts and sporting events.” As more and more Americans are choosing to spend their money on travel instead of material goods, we’re seeing higher prices at these vacation destinations.

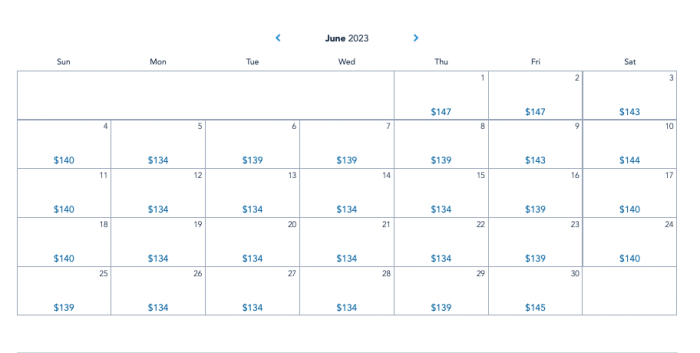

When it comes to ticket prices (for our purposes we’re going to look at single-day, non-park hopper tickets), Disney has a range of prices. Tickets start at $109 and can get as expensive as $159. How much you’ll spend on a ticket depends on the day you want to go. Naturally, on days that are sure to be more crowded (think Christmastime), tickets are going to cost more (which goes back to the supply and demand premise we were talking about earlier).

So, is Disney increasing ticket prices? Not technically, but what we’ve found is that in 2023, there are more days that are on the higher end of that spectrum than there were in 2022. So while Disney isn’t outright raising ticket prices, it may still be more expensive to go next year. That’s similar to what we saw for ticket prices in 2022, where some dates were placed into higher ticket price categories.

Tickets aren’t the only place we’re seeing price increases. Disney World restaurants have seen hundreds of price increases and we’ve also seen smaller price increases on merchandise like nuiMOs and MagicBands.

Once again, calling back to that ever-so-prevalent supply and demand issue, it may be harder to get some of the things you’re looking for when you’re on your Disney vacation. For example, we’ve seen a shortage of bubble wands in the past, as well as misting fans (though some of those supply issues have been resolved).

You may also notice portion sizes decreasing (something called shrinkflation, where you pay the same amount for less). In 2021, Disney’s Chief Financial Officer Christine McCarthy, in discussing inflation, said “There are lots of things that are worth talking about. We can adjust suppliers. We can substitute products. We can cut portion size which is probably good for some people’s waistlines. We can look at pricing where necessary. We aren’t going to go just straight across and increase prices.” So you may find yourself paying more for less.

And getting to your vacation will be more expensive now than it was before. Both gas prices and airfare prices are decreasing at the moment, but things could change.

Disney is aware of rising inflation and commented on it during one quarterly earnings call. In an attempt to mitigate the impacts of the faltering supply chain, Disney Chief Financial Officer and Senior Executive Vice President Christine McCarthy said that the company is working to diversify its suppliers to make sure the stores are getting stock, and the company is also working with the shipping companies to reduce shipping lead times.

Unfortunately, given the fluidity of the situation, it’s really difficult to say how inflation will impact Disney in the long run, but we’ll be keeping an eye out for any updates we can bring you.

For now, expect for various parts of your vacation experience — travel, food, merchandise, etc. — to cost more due to inflation increases. Be sure to adjust your budget and plans as needed to account for these increases, and don’t let changes caused by supply issues (like missing merchandise or menu changes) catch you off guard!

Click here to see 8 new price increases to plan for in Disney in 2022

Heading to Disney World and want to do it on a budget? Luckily there are a few ways you can save money on your vacation and still have a great time. Check out our list of the biggest ways to save money in Disney World here.

A great place to start when saving money is to take a look at the cheapest days to go, so you know you’re saving when it comes to tickets. As always, make sure to stay tuned to AllEars for the latest Disney World news.

Click here to see why your 2022 Disney World trip will cost more than ever before

Join the AllEars.net Newsletter to stay on top of ALL the breaking Disney News! You'll also get access to AllEars tips, reviews, trivia, and MORE! Click here to Subscribe!

Are you heading to Disney World soon? Let us know in the comments!

Trending Now

From time to time, rides and attractions are taken out of production temporarily for various...

We found your perfect Hollywood Studios tee.

We're digging into Disney World's Magic Kingdom expansion plans!

You may be taking a BIG risk to get on this Magic Kingdom attraction. Here's...

One Disney World park is about to celebrate a big milestone!

Let's talk about some Criminally Underrated EPCOT hotels!

Planning to ride Space Mountain on your next Disney World trip? Here's when you WON'T...

There's a NEW roller coaster coming to Epic Universe in Universal Orlando, and we've got...

Who is excited for summer? There is a new collection online at Target that Disney...

If you plan on renting a car at Orlando International Airport, read this.

We're rounding up the best souvenirs in Magic Kingdom's Tomorrowland!

We have a big Smellephants on Parade update in Magic Kingdom!

I go to Disney World alone A LOT, and these are the restaurants that never...

We've got an update for Disney's new 'Coco' restaurant!

These Disney World restaurants needs some TLC.

Planning a trip with your friends and don't know how to plan an itinerary? Don't...

These 2000+ piece Disney LEGO sets are NOT for the faint of heart...

Check out all the new photos of Universal's new Terra Luna and Stella Nova Resorts...

Let's take a look at everything that's been confirmed to return so far.

We recently visited Disney World's newest restaurant, and we have some THOUGHTS about what you...