I really didn’t think I could make a credit card work for ME, but boy, was I wrong.

As a Disney fan, the first credit card that comes to mind is probably the Disney Visa. While that has its own set of exclusive perks, including points to use in the parks and on merchandise, what happens when you travel to other destinations? That’s why I decided to try out the Sapphire Preferred card, and I’m not kidding when I say it has changed how I travel.

Disclaimer: Credit cards aren’t for everyone. This post is not financial advice—just my personal experience with a card that’s worked well for me. Always do your own research and consider your financial situation before opening a new credit card.

Why I Signed Up for the Card

After having a Disney Visa card for two years and a dream to travel abroad going on 25 years, I decided it was time to look into travel credit cards. I can’t lie — it’s overwhelming!

In the end, the Sapphire Preferred Card ended up winning because of its low annual fee, sign-up bonus, and partner brands.

At the time of writing, there is a 75,000 point bonus to new cardmembers who spend $5,000 on purchases in the first three months from account opening. 75,000 points can go a long way with hotels and flights, so this is a pretty big deal! International flights can take up the bulk of your trip budget, and points help to offset that.

The annual fee is just $95. To be honest, I don’t love the idea of an annual fee, but with the perks, it basically pays for itself. There’s also the Chase Sapphire Reserve Card, which is in a league of its own, and I would only recommend it to jet setters who are constantly traveling. It has a seriously amazing set of perks, but the annual fee is $795. I couldn’t commit to that quite yet, but I was happy with my choice in the Preferred Card.

The ✨ Perks ✨

Let’s talk perks — because this is where the Chase Sapphire Preferred really starts to shine. After two years of using it, I’ve realized it’s not just a credit card; it’s basically a travel rewards engine. Here’s what makes it so valuable:

Transfer Points to Travel Partners

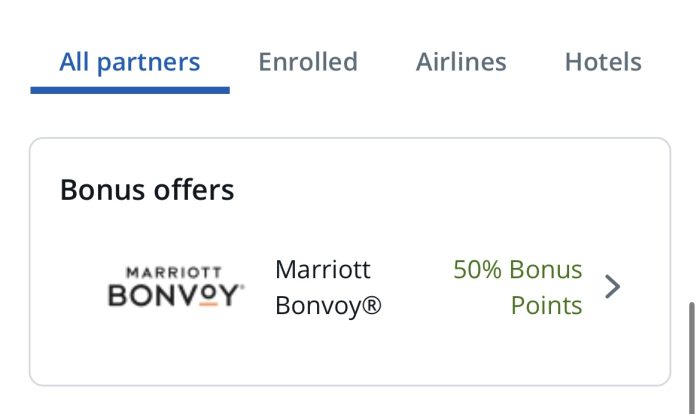

One of the biggest perks? You can transfer your Chase Ultimate Rewards points to a bunch of airline and hotel partners — usually at a 1:1 ratio. This is often where you’ll get the most bang for your buck (more on that in a sec).

Here are the airlines you can transfer your points to:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Club

- Club Iberia Plus

- Emirates Skywards

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

And these are the hotels:

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

Everyday Spending

The Sapphire Preferred also rewards you for spending in categories that travelers (and food lovers) will appreciate:

- 5x points on travel booked through Chase Travel

- 3x points on dining (including delivery services like DoorDash and Uber Eats)

- 3x points on select streaming services

- 2x points on all other travel purchases

- 1x point on everything else

It’s not all about the big purchases — those nights for ordering in and Netflix binges are quietly helping you earn your next trip.

Bonus Partners

With your card, you get a complimentary DashPass membership for one year. It gives you $0 delivery fees and reduced service fees on eligible DoorDash orders. Perfect for those nights when cooking is not happening. DashPass members also get a $10 credit every month (yep, $120 a year) to use on groceries, retail orders, and more. Just make sure to activate the benefit by December 31st, 2027.

If you use Lyft, this one’s a no-brainer. You’ll earn 5x points on every ride through September 30th, 2027, when you pay with your Sapphire Preferred.

Also, for all the Peloton fans out there, Chase is offering 5x points on eligible Peloton equipment and accessories over $150. This perk is available through December 31st, 2027, as well.

Oh, and don’t forget about the $50 annual hotel credit when you book trips through Chase Travel!

The Perk That Saved Me Thousands

There’s one perk that saved me thousands of dollars, and it’s one I didn’t know about until I happened to find it in the Chase portal! Every so often, Chase runs limited-time offers where you’ll get extra points when you transfer to specific travel partners — usually anywhere from 20% to 40% more. It feels a bit like finding a secret level in a video game where your points suddenly go a lot further.

One of my favorite wins? I transferred points to British Airways during a 30% bonus promotion, meaning I got 30% more points for free just by moving them over. I was eyeing a premium economy seat for an international flight, which normally would’ve required a ton of points. But thanks to the bonus, I ended up using way fewer points than I expected — and I’ll still get to fly in comfort (and with actual legroom).

Of course, you’ve got to do the math. Sometimes booking through Chase Travel is better. Other times, the transfer + bonus combo absolutely crushes it in value. I usually take a few minutes to compare both before I book — it’s an extra step, but it’s 100% worth it when you realize you’re flying premium for less than the price of economy.

Have you tried out any credit cards with travel perks? Let me know what you think of yours in the comments. Stay tuned to AllEars for more!

Trending Now

Find out whether The Polite Pig in Disney Springs is worth a stop on your...

Act fast to get this bag in time for fall!

This is why every Disney Adult is suddenly booking a trip to Magic Kingdom in...

These 3 new shoes on Amazon are perfect for your grandma's trip to Disney World.

Let's talk about a couple of the "lies" Cast Members tell you to keep you...

Hundreds of Loungefly bags, pins, apparel, and more are up to 70% off right now!

Hurry to Amazon to get your next pair of Hokas!

We're sharing our full wrap up of the BEST Disney Amazon finds this week!

The new Pirates lounge is about to change things...

I walked over 10 miles in one day at Disney World -- and I did...

There's this one EPCOT pavilion that's always packed and we think we know why that...

We now have confirmation of when 2 DIFFERENT character dining experiences will be happening in...

These water bottles are adorable and serve an awesome function for your hydration needs during...

DVC is kicking off their Welcome Home Weeks which means you could be entitled to...

There's a NEW Bath & Body Works collection featuring two of our favorite Disney Villains...

Let's find out what are the weirdest things that you do in Disney World!

Disney's Cool Kid Summer is coming to an end, and the park is going to...

These membership perks fly under the radar.

Beak and Barrel reservations will officially open (again) on August 20th!

Some new Disney Halloween Loungeflys are online now.