The activist investor group Trian Partners has been involved in a proxy battle against Disney as they seek to secure a seat on the board for Trian CEO Nelson Peltz.

The group has released a presentation detailing past failures of Disney’s Board of Directors and explaining why Peltz would be able to increase value for shareholders. Now, Trian has zeroed in on a specific board member they think should be removed in order to make room for Peltz.

Nelson Peltz has worked with Disney in the past, advising CEOs and the board and making known his opinion on certain company decisions. His investing company Trian owns 9.4 million shares of Disney, which is valued at approximately $1 billion.

Peltz takes issue with some of Disney’s recent decisions, particularly the Fox acquisition (which he claims Disney overpaid for) and the poor succession planning for CEO Bob Iger. He is advocating for a seat on Disney’s Board of Directors so that he can have more of a say when it comes to company decisions.

Activist investor groups are essentially businesses that invest heavily in public companies and then work with those companies to increase shareholder value, thus earning a profit when they sell their own shares of that company. Peltz has been on several company boards, and he’s engaged in a few proxy battles along the way (some of which he’s won, others he’s lost).

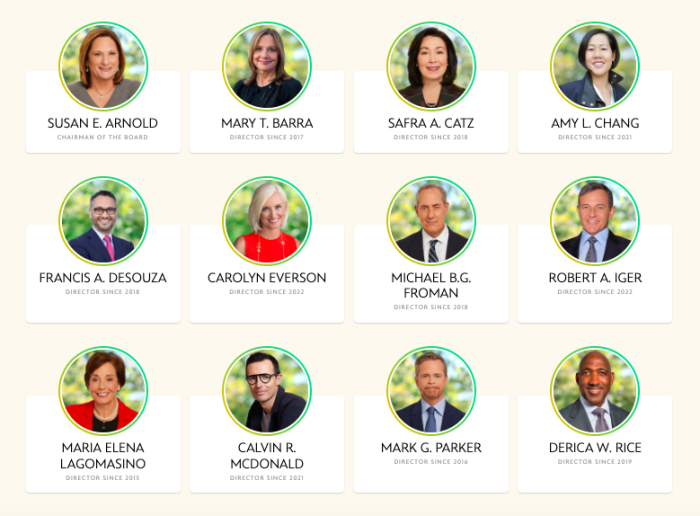

Up til now, Trian has pushed for Peltz to be added to Disney’s board, but they didn’t specify who they think should be removed from the board in order to make room. On Thursday, February 2nd, Trian released a statement saying that current board member Michael Froman should be removed to make room for Peltz (CNBC).

The filing states that “Trian Group believes Mr. Froman has no experience as a public company director outside of Disney.” They claim that, by contrast, “Nelson Peltz has served on numerous public company boards over the last several years.”

Froman is currently the vice chairman and president of strategic growth at Mastercard, and he has served on Disney’s Board of Directors since 2018. He was the U.S. Trade Representative under President Barack Obama (beginning in 2013 and ending in 2017).

Disney has previously defended the current board and CEO Bob Iger, stating that “Peltz has no track record in large cap media or tech, no solutions to offer for the evolving media landscape.” They are encouraging shareholders to vote for the board’s nominees and not for Nelson Peltz during the upcoming annual shareholder meeting, where a vote will determine the winner of this proxy battle.

We’ll keep watching for more updates on this situation, so stay tuned to AllEars for all the latest Disney news.

Click here to learn all about Peltz’s relationship with Disney.

Join the AllEars.net Newsletter to stay on top of ALL the breaking Disney News! You'll also get access to AllEars tips, reviews, trivia, and MORE! Click here to Subscribe!

What do you think about the proxy battle between Peltz and Disney? Let us know in the comments.

Seems like Mary Barra would be a better target based on the lame management she has displayed at GM IMO. The needless last minute supply issues, the badly planned execution on the Chevy Bolt. The failures to get the software right in the Hummer EV and the Cadillac Lyric and the idiotic hand built caddy. They have been in the EV game forever since the grand failure of mismanaging the EV1 and still fail to get it right. This person does not belong on anyones board. Mr Froman may also be ill fitted but in my opinion Ms. Barra has even less to offer.

there are those that no matter what will only see dollar signs in their life. i hope that the disney board will remain focused on what walt disney wanted to do for families, can you imagine a little girl seeing her favorite princess for the first time at walt disney world or mickey mouse?? do you think she is thinking about profits for shareholders and do you think her parents have those thoughts? i think every decision should be based on what would walt disney say and do.